EA Risk Management: How To Secure Trading

- EA Risk Management

- What Risks Should Be Considered?

- Risk Management System Sample

- In Conclusion. What Should I Do?

EA Risk Management

A lot of traders extol and pay particular attention to the trading system when creating an EA. For example, they are incredibly careful about determining exit and entry market points. Do not fall into this trap!

Yep, almost each and every new player in the field of trading keeps making this mistake. You should know that this maniacal search for a beneficial trading system neutralizes another significant issue:

“How to secure the trading deposit?”

Set aside anxiety! Risk management will help you to find the answer. This aspect is as crucial as a trading system.

That is why no one should neglect risk management since this saves novice traders’ accounts and money.

Risk management in the EA is an algorithm that describes unrealized losses on the account. Also, it describes actions to be taken in case of reaching the risk limit.

When creating a robot algorithm, you have to consider:

- Trading system

- Money management

- Risk management

You cannot trade an EA without proper risk management since trading has a psychological impact on the trader. If the current position is beneficial, you can feel greedy. Otherwise, you may get scared. In this case, a trader interferes with the robot’s trading process and disrupts the entire trading system.

You can cope with psychological pressure if you are confident that the deposit is protected by the risk management rules. The smaller risks, the smaller the negative emotions.

What Risks Should Be Considered?

There are critical risks to maintaining balance. Here they are:

Risk per trade/series

This kind of risk represents how much a trader is willing to lose per one order. When opening several trades, the risk is indicated for the entire series.

To test the trading system, you need the Expert Advisor’s ability to trade the mini lot. You can increase risk after testing in the real market.

The boost is carried out gradually, starting from 0,25% of the risk deposit per one trade. The risk can be increased step by step once a month or quarter. Risk loss per trade should not exceed 1% of the deposit.

Note! Deposit disposable money only!

An Example of the Stop-Loss Trade with 1 % of the Deposit

An Example of the Stop-Loss Trade with 1 % of the Deposit

This approach allows you to withstand a loss-making trades series without psychological stress.

Risk per day

This kind of risk represents how much a trader can lose per day.

Sometimes volatility increases. Multidirectional trends are observed in the market. It is due to natural or synthetic disasters, terrorist attacks, political or economic events, etc. The trader does not monitor the robot’s work and does not have time to intervene.

That is why it is better to limit the risk loss per day. This risk should be small (~3-5% of the deposit). After reaching the limit, trades must be closed. It is better to lose 5% of the deposit than to continue trading and lose 10-20% in a crisis.

Risk per week

This kind of risk represents losses per week.

A trading system based on the volatility of 100 pips per day causes losses with 200 pips volatility. You need to set a risk limit.

Note! Close trade if there is a 10% deposit loss in the first days of the week.

Analyze: What changes have occurred on the market? What events are in the world? If the market is stable, open trades next week. If the market is in abnormal conditions, wait and resume trading after the market stabilizes.

Risk per month

This kind of risk determines losses per month.

The financial crisis can last for several months. Limit losses per month to cut damage. The trading system will become poor functioning during the crisis. Limit trade risks per month to 20% of the deposit. When the limit is reached, trading is suspended.

Analyze the market conditions and the drawdown reasons.

Maximum drawdown

It is the head risk, the last account defender against excessive losses.

This kind of risk determines the maximum drawdown on the account. Its optimal size is 30% of the deposit.

Deep drawdowns are undesirable because their exit is too protracted. Such drawdowns (~30%) are acceptable for investment.

After reaching the maximum drawdown, the EA ceases to function. Optimize trading system for the current market.

Risk Management System Sample

Let us consider an EA risk management sample:

-

Set a risk percentage of a deposit per trade. Upon reaching a limit, you should continue trading.

If the deposit is $10 000, the risk per trade is 1% of the deposit ($100).

-

Set a risk per day. Upon reaching a limit, you should close trading this day.

If the deposit is $10 000, the risk per day is 5% of the deposit ($500).

-

Set a risk per week. Upon reaching a limit, you should stop trading this week.

If the deposit is $10 000, the risk per week is 10% of the deposit ($1 000).

-

Set a risk per month. Upon reaching a limit, you should close trading this month.

If the deposit is $10 000, the risk per month is 20% of the deposit ($2 000).

-

Set a maximum drawdown. Upon reaching a limit, you should stop trading.

If the deposit is $10 000, the maximum drawdown is 30% of the deposit ($3 000).

A system with proper risk management has a stable equity line shape:

An Example of the Trading System Providing Risk Management

An Example of the Trading System Providing Risk Management

Stop Losses occur periodically, and the equity line shape falls. However, fixed losses (according to the risk management rules) are small, and profits are high.

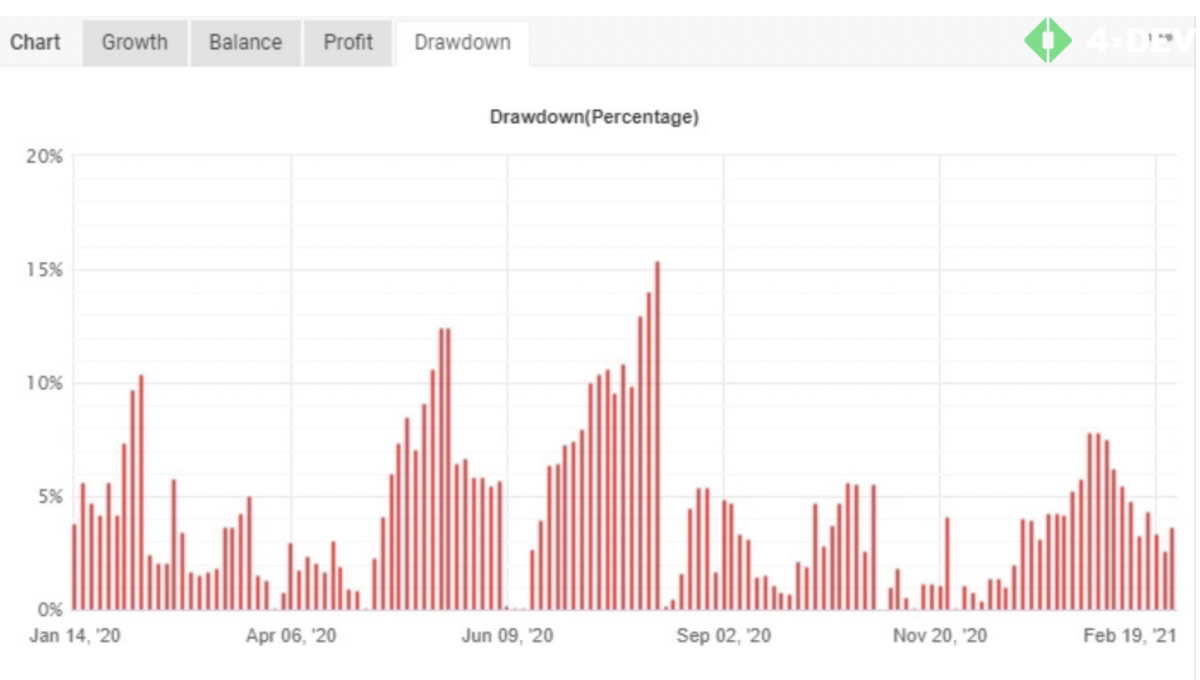

A Drawdown Histogram

A Drawdown Histogram

Drawdowns were small. For example, the maximum one was ~15%.

So, we can say that the symbiosis of a properly arranged trading strategy and risk management gives positive results. What good news!

In Conclusion. What Should I Do?

Risk management is a significant part of the Expert Advisor. Keep it in mind, bro!

Note!

- When generating EA algorithms, do not forget about risk management.

- Set risk (per trade, day, month) and a maximum drawdown. Determine the actions to be taken after these risks are reached.

- Risk management serves to protect the account and your peace of mind.

Manage your risks to perform long-term Forex trading. Use high-quality EAs with full-fledged risk management. Order the top-notch trading stuff created by the 4xDev company!

Do you doubt the reliability of the indicator? Want to check if there is no redrawing? Need an expert programmer to develop a custom Forex indicator? We will do it for you! Just fill in a form and get a free estimate of the price and time needed to develop the desired tool.