The Essential Components of a Profitable Trading Strategy

Components of a Winning Trading Strategy: Top 9 Picks

Although the components of a trading system may be apparent, a few of them are frequently unnoticed. In this guide, we are going to discuss the next elements:

- Entry strategy

- Exit strategy and trade management

- Instrument universe

- Momentum

- Multiple timeframes

- Position size

- Price pivot areas

- Trend filters

- Volatility

Think through each of these aspects when developing your trading strategy. Ensure that there are no surprises down the line when your trading robot starts live trading.

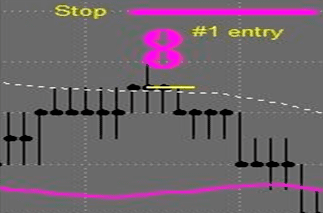

Entry Strategy

Entry Strategy

Entry Strategy

Do you find yourself not knowing when to pull the trigger? So, you lack a well-thought-out entry strategy.

An entry strategy is a set of rules that lets you know the right time to pull the trigger, place an entry, or stop one. If you can coordinate this properly, you are on a smooth sailing ship.

You need a trading signal or trigger to make a trade. It could be complex like the one that requires confirmation. Or it can be simple like a moving average crossover.

You must check the current position and the capability to accommodate fresh risks before generating a trading signal.

Exit Strategy and Trade Management

Several trading systems possess a blend of exit strategies. They form a trade management arrangement when together.

You can exit a trade by either reaching a profit target, applying a trailing stop to protect an open profit, or simply stopping it at the initial Stop Loss level.

Using various exit strategies to split the position up may not boost its long-term productivity. However, it can make the equity curve smoother by shielding some profits while letting a fraction of the trade gain from extensive moves.

Several automatic trading software can contain quite complicated exit strategies. So, it’s good to use this technicality to smoothen the equity curve.

Position Size

Position sizing is sometimes sophisticated or simple when the system holds several positions. The system should be able to read the overall account size and current position to calculate a potential risk.

Several traders ignore the trading instruments. It is wrong because each notional value lot determines the minimum position size indicating the minimum account trading strategy size. $100,000 is normally used when applying automatic trading software to do a backtest. When trading a smaller live account of $10,000, the lot size might be huge. Hence, you must consider the minimum viable account size when developing a strategy.

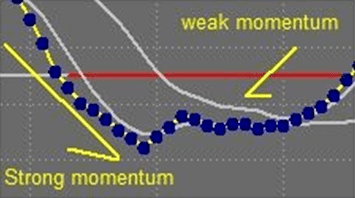

Momentum

Momentum

Momentum

It can be tremendously helpful to insert an additional level of perception through "momentum" indicators.

Since price changes have different movements, it is crucial to evaluate the strength (or weakness) behind a price move. You can anticipate the holding or breaking possibility of an area by gauging momentum into potential pivot areas.

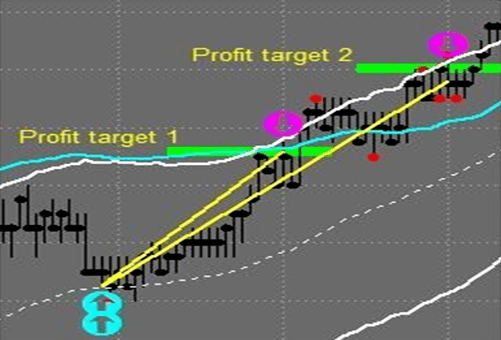

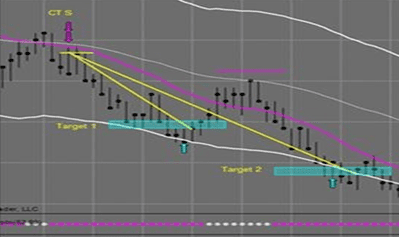

Profit Targets

Profit Targets

Profit Targets

There are numerous options when using profit targets.

Traders who employ automatic profit targets, dependent on the pre-determined value of dollars, are in a particular section. An instance is when you might use an automatic target of 4 points ($200 per contract) on the S&P 500 e-mini futures contract.

On the other hand, you do not need to use a target and close the trade only when the market exiting conditions look favorable.

Hence, you can employ "dynamic profit targets" to determine the primary profit prospect on a trade. It leaves you open to taking profit before or past the primary target based on what the market is displaying you.

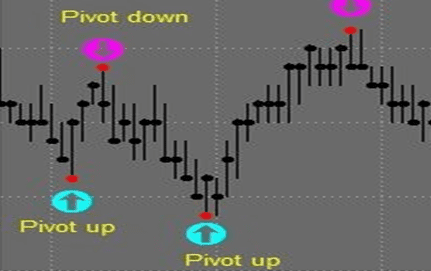

Price Pivot Areas

Price Pivot Areas

Price Pivot Areas

We do not mean floor trader pivots or any single way of pre-plotting potential pivot areas when we mention "price pivot areas." We are observing the market activity to find out recent areas where the possibility of pivot is high.

You can find pivot areas in numerous ways. For instance, you can use fundamental price support and resistance. Furthermore, you can use various indicators and oscillators to predict an accurate time that the price will see a pivot.

Volatility and Trend Filters

Volatility and Trend Filters

Volatility and Trend Filters

Though filters are not a total necessity, many trading systems possess them.

A filter identifies a trade setup and the market conditions to carry out the trade. When you combine volatility and trend indicators, you will create a filter that determines the correct market conditions.

Several large-trading systems halt performance immediately when there are alterations in the market conditions. This option is the best to reduce your worry caused by money loss.

Instrument Universe

It is unnecessary to write the trading instruments list in the code though it is a part of the strategy. You should do it only when a trading bot does not function alongside some instruments.

So, then you can include this in the code or simply jot it down somewhere as a reminder. It will prevent you from mistakenly running the system on a currency pair or instrument with no profit.

Multiple Timeframes

Many traders get confused as they use a dozen timeframes for a single market.

Meanwhile, it should be just two timeframes to trade a single market. It will allow having various "zoom levels'' to pinpoint your entries and manage your exits.

Additionally, you should use your "main chart" when looking for setups to line up. Apply a smaller chart as your "entry chart" to pinpoint the entry and determine temporary momentum.

In Conclusion

To have a profitable trading strategy, you must be consistent in your trades. When you come across something that functions properly, maintain it instead of following other traders to “system hop,” thereby losing money and time.

You should ensure that your strategy is at least 110% certain to help you draw consistent profits from the market.

Have you gone through our write-up completely? Are you willing to take your trading strategy to another level? You can automate your Forex trading strategy by contacting us.

At 4xDev, we handle MQL4/MQL5 programming services. Moreover, we develop EAs and Custom Indicators for MetaTrader® 4 and MetaTrader® 5 trading platforms.

All we need is your idea and a set of rules that can be implemented for the strategy coding. Send us your software requirements specification, and we get to work.

Feel the miracles of trading — with 4xDev.

Do you doubt the reliability of the indicator? Want to check if there is no redrawing? Need an expert programmer to develop a custom Forex indicator? We will do it for you! Just fill in a form and get a free estimate of the price and time needed to develop the desired tool.