Loss Averaging and Rapid Profit Taking: The Key Principles that Every Counter-Trend Trading Robot Should Follow

- A Trading Strategy for the EA: Average the Losses and Take Your Profit Quickly

- Deciding on Money Management for a Counter-Trend Trading Robot

- Deciding on Taking Profits for a Flat Trading Robot

- In Conclusion. What Should I Do?

A Trading Strategy for the EA: Average the Losses and Take Your Profit Quickly

Counter-trend (or else called flat) trading systems are prevailing. Why are they so popular? Because the market stays in a flat 70-80% of the time, and only 20-30% — in a trend.

An Example of Flat and Trend Ratio of the Market

An Example of Flat and Trend Ratio of the Market

The key features of counter-trend systems:

- Flat systems are built on mean reversion. If there is a strong deviation from the weighted average price, there is a high probability that the price will return to the average.

- Flat trading strategies seek entry points in the area of the price corridor boundaries. They expect the price will return to the middle of the corridor or its lower border.

- Flat trading systems assume that it is easier for the price to stay in the previous range than to leave it. Therefore, entry points are sought after a false breakout of crucial levels to return to the range.

Using these counter-trend trading system features, you can build Expert Advisors that can successfully trade in the flat market.

Note! Such Advisors need effective management from a trader. If you launch such a robot to trade in the entire market, it will be successful while the market is in a flat. However, it will lose all earned profits as soon as the market reverses into a trend.

What is the solution to this problem?

Efficient management of your Advisor!

You should develop the algorithm for determining the state of the market and test it on history. You have to launch a flat-trading Advisor on those instruments that are currently in a flat. Only then your trading robot can start showing stable results.

Deciding on Money Management for a Counter-Trend Trading Robot

Money management is essential when developing an EA algorithm. Here are the possible options that you can implement in your trading robot:

-

A standard lot trading. The EA can open a trade with a standard lot, setting a Stop Loss in points. And if that trade closes negatively, the next one will open with the same lot.

It is the simplest and safest method of money management in a robot. But its effectiveness is justified only in highly accurate trading systems, where the market entry point is chosen with a high probability of the profitable trade. This method imposes high requirements upon the trading system to give positive results.

-

The setting risk in percent or dollars per trade. This method assumes the trading position’s size to change depending on the value of the Stop Loss in points. If the Stop Loss is small, the trade volume will be large. And vice versa.

This method can give a great profit to the trading system, which should be tested at least on the minimum standard lot. If the results are good, this method is proven to be used in practice. However, the trading system requirements are still high since the Stop Loss in dollars is fixed.

-

The averaging of an open position. This money management method is prevalent among novice traders. If the market moves against the opened position, the second trade opens after a specified distance in points. And so on. The robot can open several averaging trades with a gradually rising lot size. Thus, a trading position is acquired not at one point but in a certain price range. It allows you to trade more flexibly and, with proper risk management, highly efficiently.

An Example of Position Averaging

An Example of Position Averaging

Since this method of capital management is high-risk, consider the following recommendations:

- Limit the number of averaging trades

- Limit the maximum volume of the averaging trade

- Set the total risk for a series of averaging trades to 1-2% of the deposit

- Set the averaging step large enough to allow the market to move over a wide range

When developing an Expert Advisor, you can implement all these three methods of money management. As you gain experience, you can collect trade statistics for all of them to determine the most efficient one.

Deciding on Taking Profits for a Flat Trading Robot

In flat trading systems, you should not expect big profits since the price stays in a range. Its movements are short. Therefore, it is necessary to implement the following principle: Take profit quickly!

Whereas you outwait and average the losses, your Take Profit must be carried out quickly and in small amounts. Here are some profit-taking options:

- Take Profit is fixed when the price reaches the predetermined point, for example, the middle of the trading channel.

- The Take Profit is set in dollars, regardless of where the price is.

- A combination of the two above described methods, whichever comes first.

Trading robots built on the principle of averaging losses often use a fixed Take Profit in dollars. If it is not large, it can give stable results.

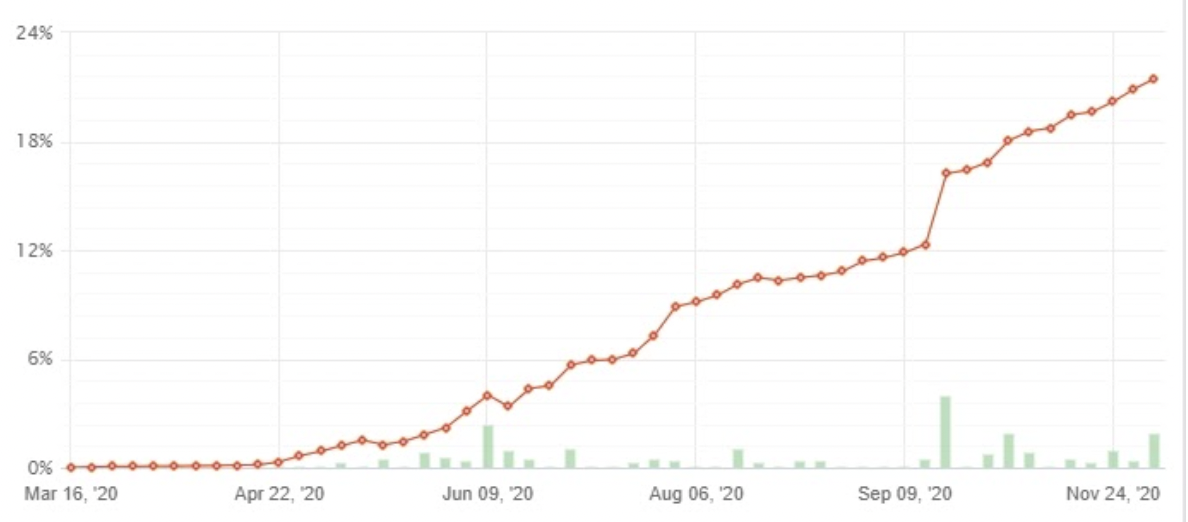

An Example of the Capital Curve Growth of the Expert Advisor Designed According to the Loss Averaging and Quick Taking Profits Principle

An Example of the Capital Curve Growth of the Expert Advisor Designed According to the Loss Averaging and Quick Taking Profits Principle

In Conclusion. What Should I Do?

The key points of efficient trading with the help of a robot created for a counter-trend trading system:

- Launch this EA when there is a flat in the market.

- To average, wait out losses and control risks tightly. If the loss has reached 1-2% of the deposit, close all trades and start looking for entry points again.

- Take your profit quickly. Since the flat’s movements are short, trades can be closed upon reaching a predetermined small profit in dollars.

The 4xDev programmers can create a top-notch counter-trend trading robot with risk management and money management criteria. Order the development of your profitable Expert Advisor and start making money in the market right now!

Do you doubt the reliability of the indicator? Want to check if there is no redrawing? Need an expert programmer to develop a custom Forex indicator? We will do it for you! Just fill in a form and get a free estimate of the price and time needed to develop the desired tool.