Why Should You Use Robots for Trading?

- Do I Need Robots on the Exchange?

- What Is a Trading Robot?

- What Are the Advantages of Trading Robots?

- What Are the Disadvantages of EAs?

- How to Start Using Trading Robots?

Do I Need Robots on the Exchange?

According to some reports, 80% of trades on up-to-date exchange platforms are performed by robots. To keep up with the times and progress, you should apply automation using trading robots and Forex Expert Advisors. At the moment, this is no longer a matter of choice. This is a vital necessity for a trader. This is a matter of survival in the market.

Digitalization and robotization are progressing in almost all sectors of the economy. Beyond doubt, this also happens in the financial markets since they are the world economy’s blood. Moreover, these markets provide the quickest access to making big profits.

Therefore, the fastest computers, data networks, and the best minds are concentrated in the financial sector. The largest banks, investment funds, and hedge funds have been using automated programs on the stock exchange for decades. Some companies specialize only in quantitative investing methods that are impossible without applying exchange robots.

What Is a Trading Robot?

A trading robot (Advisor, Expert Advisor, EA) is a program that:

- Analyzes the market according to a predetermined algorithm

- Opens or closes deals

- Selects the position volume

- Controls risks

What Are the Advantages of Trading Robots?

EAs have many pros. Do you doubt it? The list below will prove to you that even a novice trader needs to master trading using FX robots.

✔ Systematic trading. You need to write a robot program that will be used for trading. More often than not, a good trader is not a good programmer. Just like a good programmer is not a good trader. Therefore, you should find a coder who specializes in creating EAs.

Then, you will have to write a software requirements specification for them. Make your trading system or idea clear for another person. Describe specific aspects in detail so that a coder can write a program for you properly. The process of SRS preparation helps finally decide on the trading system, capital management, and risk management.

You can face many problems because of the lack of systematic trading. However, such a scenario is impossible if you trade using advisors. An EA trades according to a fixed trading algorithm (code, program). So, there are no unnecessary steps.

✔ Time-saving. You have to check your trading system on history. Manual testing is a crucial but time-consuming process. You can test a trading robot automatically on historical data. Complete a long-period backtest in just a few minutes using backtesting software, such as Forex Tester.

Backtesting allows you to test many different trading systems and EAs in a short time. That is a huge advantage since you do not need to spend hours testing your robot by trading on the live account. If the EA does not bring results on historical data, it can be unprofitable in the real market.

✔ Money-saving. You do not need to test an EA's effectiveness by going live. This often leads to huge losses of funds. If a trading robot is written according to your strategy, everything can be checked on historical data without spending money.

✔ Stress-relieving. A negative mental state often prevents traders from trading profitably (even if they have a nice trading system).

With increasing position size, traders tend to yield their:

- Emotions

- Pain from possible losses

- Fear

- Greed

This affects trading dramatically.

An FX robot trades according to a pre-written algorithm. No psychological factors are applied. Thus, the efficiency of trading increases.

✔ Speed. An EA is faster than a person. Considering that modern markets are accelerating more and more, it is critical to make trading decisions faster. Because of the high speed, you can miss profitable trades or even make wrong decisions according to Murphy’s law. This leads to jeopardizing the capital curve. Moreover, this makes a good trading system to quickly go down.

✔ Concentration. If you regularly trade intraday for several hours a day, it can be tough to keep your attention steady. A person can be distracted. For example, you may go to lunch and miss a profitable trade. There are no such problems with a robot. The EA constantly remains concentrated.

✔ Multifunctionality. Expert Advisors allow you to trade on different timeframes, dozens of trading instruments, and hundreds of trading strategies simultaneously. One trading robot can be launched on various assets, thereby reducing risks and increasing the trader’s profit.

Such multifunctionality is not available to one trader. A trader can track and trade efficiently on no more than 1 to 2 instruments within a day. A robot can track down and trade thousands of them.

✔ Portfolio. The main advantage of trading robots is creating a portfolio of trading strategies on different instruments. Previously, the trading portfolio was available only to investment funds. However, thanks to trading strategies’ automation, it has become accessible to general traders.

Strategy portfolio containing different trading robots allows you to:

- Diversify risks

- Get a more stable profit. If one strategy brings losses, the others can bring profit

- Have a smoother equity curve

- Have a smaller size of maximum drawdowns

- Make money on trends that periodically appear on different instruments. If you only trade one asset, you will miss trends in other markets

- Attract investors thanks to better portfolio characteristics and diversification

But even though trading robots have many benefits, we should consider several disadvantages of EAs.

What Are the Disadvantages of EAs?

There is nothing perfect in the world of trading. And robots have their limitations and cons, too.

Like any car, an EA can be a perfect product and do a lot of good, but only in an experienced driver’s hands. And if you do not know how to drive a car and still try to drive it, this can lead to tragedy. The same is about trading robots.

It is essential to understand EAs' negative peculiarities and be able to manage them. So, here are some disadvantages of Expert Advisors to be aware of:

❌ Lack of evolution. The market is constantly changing, like a living, growing organism. The robot is not able to independently adapt to the successive market conditions. It is your task to refine and improve your robots, regularly adjusting to the market.

❌ Poor understanding of fundamental data. The EA may not consider global factors at all. Or it can only take into account daily news.

It is extremely tough to teach an Expert Advisor to understand and correctly interpret world events. So, it is another trader’s task to decide when to launch the robot and when not to trade because of some fundamental events (elections, cataclysms, terrorist attacks, etc.).

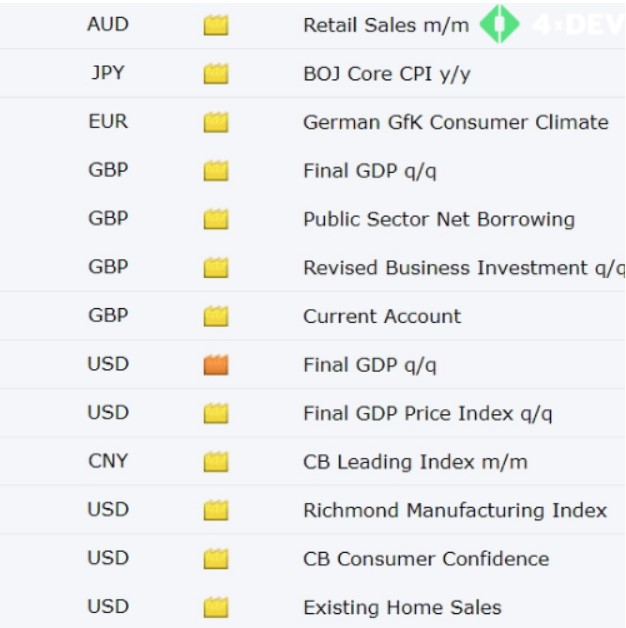

An Example of News for a Part of the Trading Day

An Example of News for a Part of the Trading Day

❌ Errors in the programming code. Traders often order the writing of an EAs program from third-party coders. Choose reliable, verified contractors and carefully check the robot’s algorithm.

Robots are not the “Holy Grail” that will make money. But if you use them correctly, you can get stable positive results and profits.

How to Start Using Trading Robots?

There are 4 steps to start applying Expert Advisors:

- Come up with several trading systems that you would like to use in automated trading applying Expert Advisors.

- Choose a reliable company to create your robots. For example, the 4xDev company has extensive experience in programming Advisors for different trading platforms.

- Backtest your EAs on history. Don’t you want to do it on your own? The specialists from 4xDev can develop a trading robot, optimize, and test it on historical data for you. If you choose to backtest the robot yourself, use professional and reliable software, such as Forex Tester.

- Create a portfolio of trading robots on different instruments within one account using the Forex Copier program. It is unlikely that one robot will be able to bring you a stable profit for a long time. You know, one is none.

Develop your portfolio, replenish it with new Expert Advisors, and adapt to the changing market conditions.

Automatic trading allows you to keep pace with the market in the future. Leave your request and get a high-quality trading robot right away!

Do you doubt the reliability of the indicator? Want to check if there is no redrawing? Need an expert programmer to develop a custom Forex indicator? We will do it for you! Just fill in a form and get a free estimate of the price and time needed to develop the desired tool.